The Downfall of the energy company Solyndra is just a microcosm of many examples of why government subsidies in general fail. Of course one could argue this was a mere 1 in 100 of energy subsidies that simply was not successful, and many simply dismiss it as a republican political attack point on the efforts towards green energy. This is true, it was harped on during the 2012 elections…but never really hit home the principle issue with subsidies. I want to preface by saying that the blog will allude to subsides in general at times…but I will do my best to stay within the realm of energy subsides; it should be noted that energy subsides are not mutually exclusive with any other subsidy in my principled points….they are all one in the same ugly boat heading towards a metaphorical glacier and impending doom, with the American taxpayers being the ones sinking (yes, that will also include Leo and Kate).

Why should I be so hard on green energy subsidies? They benefit mankind by producing cleaner energy, and create jobs in the process….its a win win right? Wrong. Nobody wins; even if a company is successful on such a subsidy, the principle of it all stinks to high heaven. No subsidy is good…therefore there cannot be such thing as good subsidies or bad subsidies; they’re bad- subsidies are bad. Anytime the government offers money to someone as a loan, it means the taxpayer (you and I) are on the hook for the money. So when the Obama administration gave Solyndra 535 Million dollars in guaranteed money and the company filed for chapter 11 bankruptcy….we bailed them out. Now the politics of the issue is the whole investigation of the company and any unethical decisions made between Solyndra and the government. As an op-ed in the New York Times wrote:

“The company’s innovative solar panels, high-priced to begin with, became increasingly uncompetitive in the marketplace. Solyndra didn’t have enough big commercial customers to create the necessary economies of scale … they ultimately failed to raise additional capital that would have allowed Solyndra to stay in business.” (1)

Oh so many things are wrong with this defense. If the solar panels were such that they were becoming unaffordable, why on earth would an investment be made to buy these? If the marketplace was uncompetitive, how on earth can you justify making a loan for a company, knowing costs were going up? It comes to no surprise the company failed to raise sufficient capital given that the government’s easy & cheap money to a company was what not only made the market so uncompetitive (after all, how can a bank compete with the US Treasury and the taxpayer as collateral?) but that this check’s stings attached were government breathing down the back of a company trying to survive. (2) My point being that government simply should be in the business of offering loans because, well…..they don’t know how to do it! The Solyndra case screams incompetence for miles and miles….and this is a mere example that can be shown over and over again in history why they fail….I’ll even explain it 10+ years ago with the failure of Enron with government backing it.

Sure enough though, this wise-guy columnist will continue to defend the effort with his heart bleeding all over his shoes.

“….we might realize that federal loan programs — especially loans for innovative energy technologies — virtually require the government to take risks the private sector won’t take. Indeed, risk-taking is what these programs are all about. Sometimes, the risks pay off. Other times, they don’t. It’s not a taxpayer ripoff if you don’t bat 1.000; on the contrary, a zero failure rate likely means that the program is too risk-averse. Thus, the real question the Solyndra case poses is this: Are the potential successes significant enough to negate the inevitable failures?” (1)

The question at the end is about as principled as he is going to get in this line of thinking. The answer is no, and the errors in the previous part of the quote help explain why. The risk government takes that the private sector won’t take is a big reason for concern, because the idea is that the faith in the private market simply is not there….If no banks were giving Solyndra a loan (more likely, a loan with high interest), they had a reason to. They calculated the risk and saw no way to offer a cheaper way to help give the capital needed to fund this company because they knew better….they saw the rate of failure being higher than that of success. That’s not unfair nor inhumane towards the cause for clean air- its smart & responsible. It is what people do with their budgets at home all the time to make sure they do not go broke or go under budget for their bills.

His lecture on the basics of risk-reward are a bit insulting to the intelligence of his readers, and only later in the piece does he defend the success story of other companies by using the crux of attacking coal plants also being subsidized by state and federal government. Once again, no subsidy is good….even if the nation’s coal power is the leader in energy production and leader in energy exportation. The flaw in reasoning behind his question posed weighing the risk of failure and success for funding of energy companies continues:

“I have a hard time answering “no.” Most electricity today is generated by coal-fired power plants, operated by monopoly, state-regulated utilities. Because they’ve been around so long, and because coal is cheap, these plants have built-in cost advantages that no new technology can overcome without help. The federal guarantees help lower the cost of capital for technologies like solar; they help spur innovation; and they help encourage private investment. These are all worthy goals” (1)

If the government helps guarantee lower costs for Solar capital, how can be that they cannot afford to buy solar panels? Private investment only comes when the risk of failure declines…..and while the success stories of the subsidized solar panels is a good counterexample, it merely leads to more artificial constructs for the market of cleaner energy due to such low interest-rates guaranteed by the government…1.025 interest for Solyndra to be exact (2)

That eerily sounds familiar to the recent financial crisis of 2007-2008…..that’s because the same principles apply. With cheap government loans the private market would not have made, it creates a phony sense of security…and the private market is “encouraged” to make an investment at similar rates. More and more of this occurs and the market ‘booms’ if enough money can be raised and profited from it. That all sounds well and good…except when the market ‘busts’. That bust occurs when the excess amount of loans given at such a cheap rate eventually cave in on themselves because they cannot pay the money back….this is due to the overly inflated cost in the industry due to so much demand along with simply not being qualified to handle the loan in the first place. This ‘bust’ that occurs is how recessions happen, and is the root cause of the financial crisis, the dot-com crisis, and almost every crisis in American history dating back to the Great Depression.

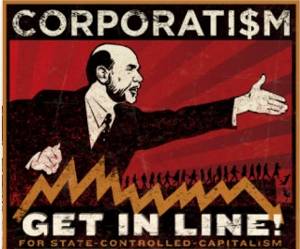

Let’s only go back 13 years when the dot-com bubble bursted. One of the major fallouts shortly after was energy giant Enron, famously known for unethical accounting standards along with rolling blackouts in the LA area amount other things to fix their misguided resources. In short, they stunk up the market and failed with very poor business practices. People were quick to blame business practices as a whole, and saw a need for more regulation of the industry…which added the Sarbanes-Oxley Act of 2002, aka the ‘Public Company Accounting Reform and Investor Protection Act’. Truth is, their failure was not of capitalism..but of crony-captialism, in which the subsidies from the government with dirt-cheap interest rates let Enron play with large sums of taxpayer money in a some-what complex method to fund risky adventures domestically and abroad…all of which cost Enron dearly. Their business practices certainly were abysmal, but in no-way reflected on the the rest of the very vast Business world….and ultimately did nothing to prevent the next financial crisis in the housing market with accounting tricks and bad loans in an inflated housing market. To quote former Congressmen Ron Paul on the Enron situation;

“The point is that Enron was intimately involved with the federal government. While most in Washington are busy devising ways to “save” investors with more government, we should be viewing the Enron mess as an argument for less government. It is precisely because government is so big and so thoroughly involved in every aspect of business that Enron felt the need to seek influence through campaign money. It is precisely because corporate welfare is so extensive that Enron cozied up to Congress and the Clinton administration. It’s a game every big corporation plays in our heavily regulated economy, because they must when the government, rather than the marketplace, distributes the spoils.”(4)

Back to center now- how does this relate to Solyndra? The failure of it is why energy subsides, as if any other, simply should not exist. Let the private market handle it; they calculate risk better, handle capital better, and guide growth steadier and farther. If the demand exists, such as for solar energy, it will be met by the market. The taxpayer should not be on the hook for energy investment…which to answer the previous question “Are the potential successes significant enough to negate the inevitable failures?” ; no they are not.

Sources:

1) http://www.nytimes.com/2011/09/24/opinion/the-phony-solyndra-scandal.html?_r=0

2) http://online.wsj.com/article/SB10001424053111904836104576558763644374614.html

3) http://en.wikipedia.org/wiki/Sarbanes_oxley

4) http://www.lewrockwell.com/orig/paul12.html

An interesting discussion is definitely worth comment. I think that you should write more on this topic, it might not be a taboo subject but usually people do not discuss these subjects. To the next! Many thanks!!

High-Throughput Oligo Synthesis Platform – BOC Sciences has built a world-leading custom platform for high-throughput synthesis of oligonucleotides, capable of providing microgram to kilogram synthesis specifications, meeting the needs from laboratory level to commercial level.